Navigating Retirement Tax Landscapes: A Guide To The Kiplinger Retirement Tax Map

By admin / September 23, 2024 / No Comments / 2025

Navigating Retirement Tax Landscapes: A Guide to the Kiplinger Retirement Tax Map

Related Articles: Navigating Retirement Tax Landscapes: A Guide to the Kiplinger Retirement Tax Map

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Retirement Tax Landscapes: A Guide to the Kiplinger Retirement Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Retirement Tax Landscapes: A Guide to the Kiplinger Retirement Tax Map

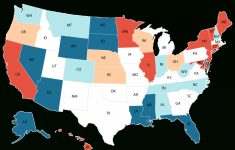

Retirement planning is a complex endeavor, often involving intricate financial decisions with long-term consequences. One crucial element in this process is understanding the tax implications of different retirement destinations. The Kiplinger Retirement Tax Map, a comprehensive resource developed by Kiplinger, offers valuable insights into the tax burdens associated with various states across the United States, aiding retirees in making informed decisions about where to settle.

Understanding the Kiplinger Retirement Tax Map

The Kiplinger Retirement Tax Map is a visually engaging and informative tool that provides a state-by-state analysis of retirement tax burdens. It considers various factors, including:

- Income Taxes: The map highlights states with no income tax, states with low income tax rates, and states with progressive income tax structures.

- Property Taxes: It analyzes property tax rates and exemptions available to retirees.

- Sales Taxes: The map identifies states with high sales tax rates and those with exemptions on certain goods and services.

- Inheritance Taxes: It outlines states with estate or inheritance taxes, including the applicable thresholds and rates.

- Other Taxes: The map also considers other relevant taxes, such as capital gains taxes, retirement income taxes, and Social Security taxes.

Benefits of Utilizing the Kiplinger Retirement Tax Map

The Kiplinger Retirement Tax Map offers several benefits for retirees seeking to optimize their financial well-being:

- Informed Location Choices: The map provides a clear picture of the tax landscape in different states, allowing retirees to compare and contrast the tax burdens associated with various retirement destinations. This information empowers them to make informed decisions based on their individual financial circumstances and tax preferences.

- Cost-Effective Retirement Planning: Understanding the tax implications of different locations enables retirees to identify states that minimize their overall tax burden. This can lead to significant savings over time, allowing them to stretch their retirement funds further and enjoy a more comfortable lifestyle.

- Financial Security and Stability: By minimizing tax liabilities, retirees can enhance their financial security and stability during their retirement years. This can provide peace of mind and allow them to focus on their retirement goals without the added stress of tax burdens.

- Retirement Lifestyle Considerations: The map allows retirees to factor in tax considerations alongside other lifestyle factors, such as climate, cost of living, and access to healthcare. This holistic approach helps them choose a retirement location that meets their needs and preferences.

Navigating the Kiplinger Retirement Tax Map: A Detailed Look

The Kiplinger Retirement Tax Map is presented in a user-friendly format, allowing individuals to quickly and easily access the information they need. The map utilizes a color-coded system, with different colors representing various tax burdens. This visual representation simplifies the analysis of tax implications across states, making it accessible to a wide audience.

Key Features of the Map:

- State-by-State Breakdown: The map provides a comprehensive overview of tax burdens for each state, enabling retirees to compare and contrast different locations.

- Tax Category Filters: Users can filter the map by specific tax categories, such as income tax, property tax, or sales tax. This allows for a focused analysis of specific tax burdens relevant to their financial situation.

- Interactive Functionality: The map is often presented in an interactive format, allowing users to zoom in on specific states, view detailed information about individual tax categories, and access additional resources.

- Additional Resources: The Kiplinger Retirement Tax Map often links to additional resources, such as articles, calculators, and tax guides, providing further insights and support for retirement planning.

FAQs: Addressing Common Concerns about the Kiplinger Retirement Tax Map

1. What are the limitations of the Kiplinger Retirement Tax Map?

While the Kiplinger Retirement Tax Map provides valuable insights into retirement tax burdens, it is important to acknowledge its limitations. The map focuses primarily on state-level taxes and does not account for all potential tax implications, such as federal income tax or local property taxes. Additionally, the map may not reflect all the nuances of individual tax situations, such as specific deductions or exemptions.

2. How often is the Kiplinger Retirement Tax Map updated?

The Kiplinger Retirement Tax Map is regularly updated to reflect changes in tax laws and regulations. It is essential to consult the latest version of the map to ensure the information is current and accurate.

3. Is the Kiplinger Retirement Tax Map suitable for all retirees?

The Kiplinger Retirement Tax Map is a valuable resource for many retirees, particularly those seeking to minimize their tax burden and maximize their retirement income. However, it is important to note that the map is not a substitute for professional financial advice. Individuals with complex financial situations or specific tax concerns should consult with a qualified tax advisor.

4. How can I access the Kiplinger Retirement Tax Map?

The Kiplinger Retirement Tax Map is typically accessible online through the Kiplinger website or other reputable financial websites. It may be available as a free resource or may require a subscription to access.

Tips for Utilizing the Kiplinger Retirement Tax Map Effectively:

- Consider Your Individual Circumstances: Before using the Kiplinger Retirement Tax Map, it is essential to assess your individual financial situation, retirement goals, and tax preferences. This will help you focus on the information most relevant to your needs.

- Compare and Contrast: Utilize the map to compare and contrast the tax burdens of different states, taking into account the factors that are most important to you.

- Seek Professional Advice: While the Kiplinger Retirement Tax Map is a helpful tool, it is not a substitute for professional financial advice. Consult with a qualified tax advisor to ensure your retirement planning decisions are aligned with your individual circumstances and goals.

- Stay Informed: Tax laws and regulations can change, so it is essential to stay informed about the latest updates. Regularly review the Kiplinger Retirement Tax Map and other relevant resources to ensure your retirement planning strategies remain effective.

Conclusion: The Kiplinger Retirement Tax Map – A Valuable Resource for Informed Retirement Planning

The Kiplinger Retirement Tax Map is a valuable resource for retirees seeking to make informed decisions about their retirement location. By providing a clear and concise overview of state-level tax burdens, the map empowers individuals to optimize their financial well-being and enjoy a more comfortable and secure retirement. While it is important to acknowledge the limitations of the map and seek professional advice when necessary, it serves as a valuable tool for navigating the complex landscape of retirement taxes. By utilizing this resource and making informed decisions, retirees can enhance their financial security and enjoy a fulfilling retirement journey.

Closure

Thus, we hope this article has provided valuable insights into Navigating Retirement Tax Landscapes: A Guide to the Kiplinger Retirement Tax Map. We thank you for taking the time to read this article. See you in our next article!