Navigating The Path To Homeownership: An Overview Of The Indiana USDA Loan Map

By admin / July 28, 2024 / No Comments / 2025

Navigating the Path to Homeownership: An Overview of the Indiana USDA Loan Map

Related Articles: Navigating the Path to Homeownership: An Overview of the Indiana USDA Loan Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Path to Homeownership: An Overview of the Indiana USDA Loan Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Homeownership: An Overview of the Indiana USDA Loan Map

The dream of homeownership is a powerful motivator for many Americans, but the reality of navigating the complex world of mortgages can be daunting. For individuals seeking to purchase rural properties, the United States Department of Agriculture (USDA) offers a valuable program: the Rural Housing Service (RHS) loan. This program, administered by the USDA, provides government-backed loans with favorable terms, making homeownership more accessible in eligible rural areas.

Understanding the Indiana USDA Loan Map

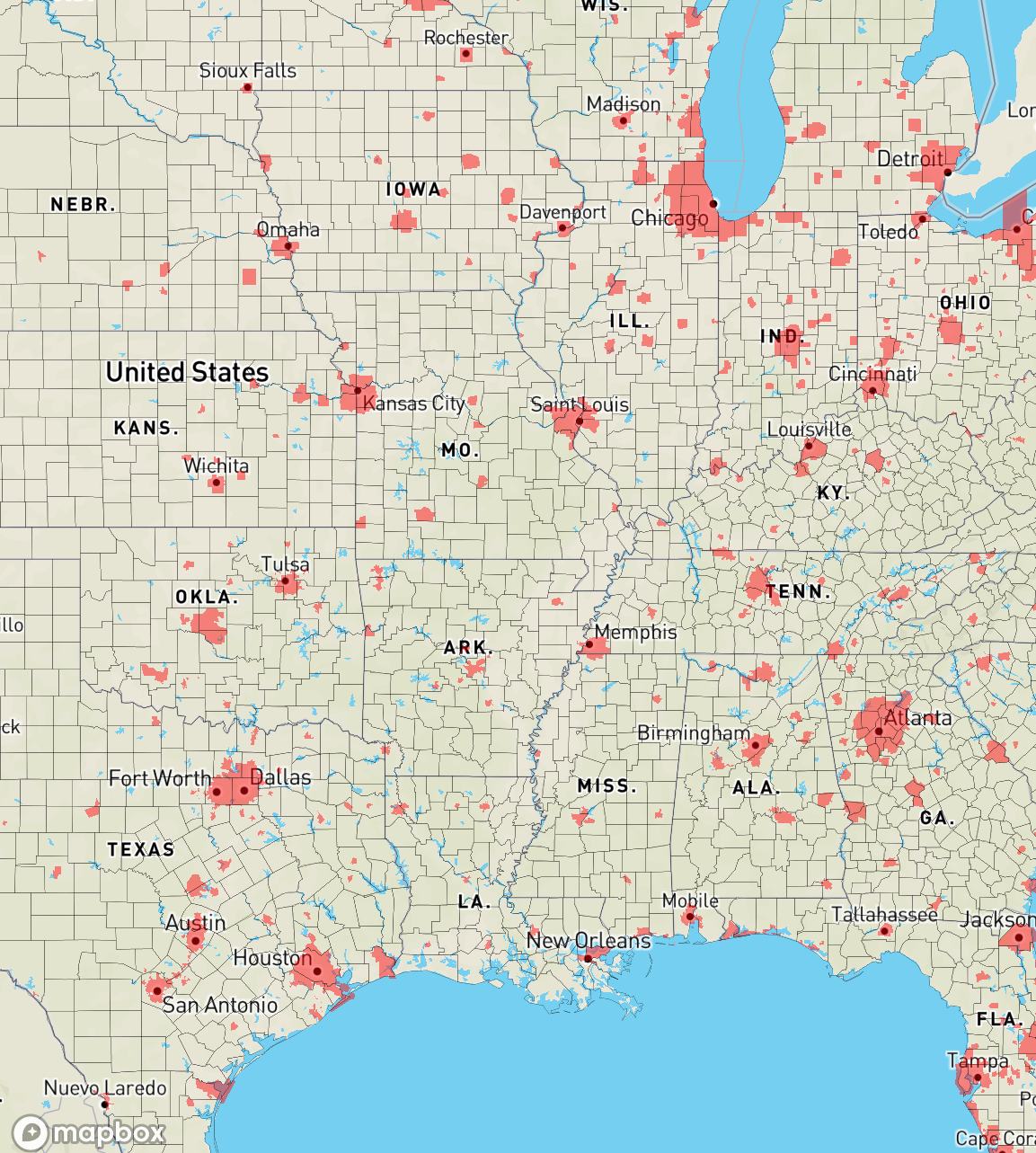

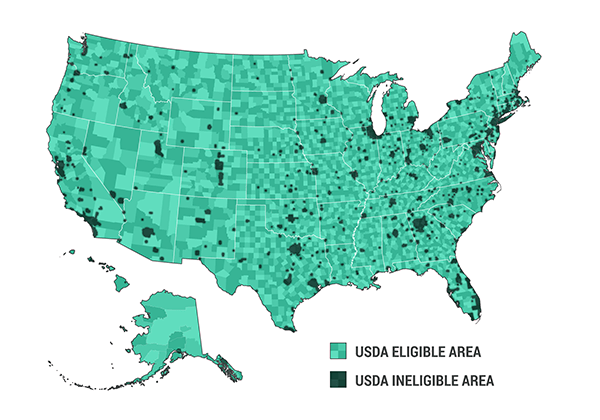

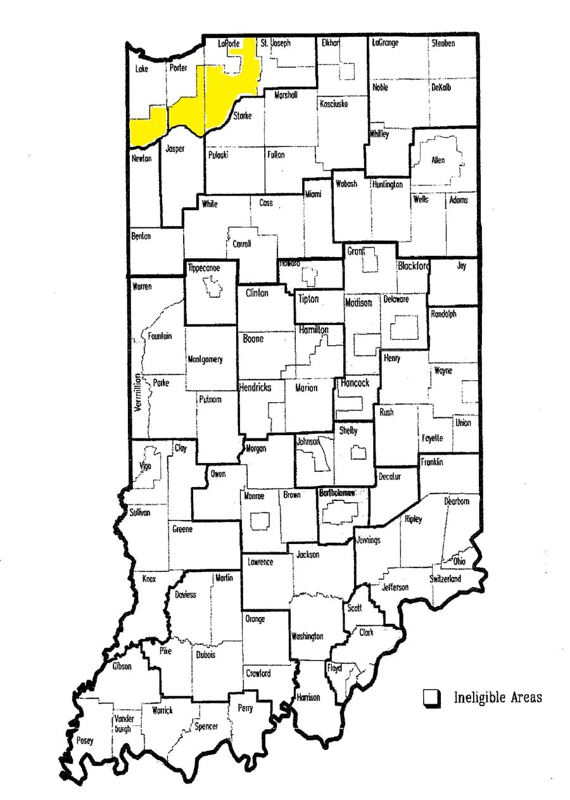

The USDA loan program is not available nationwide; it is specifically designed to support rural communities. To determine eligibility, the USDA utilizes a detailed map that outlines specific geographic areas where the loan program is applicable. This map, known as the "Indiana USDA Loan Map," is a critical tool for potential borrowers.

Decoding the Map

The Indiana USDA Loan Map is a visual representation of eligible areas, typically depicted using color-coding. Green areas indicate regions where USDA loans are available, while areas in other colors, such as yellow or red, signify ineligible locations. It’s important to note that the map is constantly updated as new areas are added or removed from the program.

Beyond the Boundaries: Defining Rural Eligibility

The USDA defines "rural" as areas that are not within a city or town with a population of 20,000 or more. Additionally, the program considers factors such as population density, proximity to urban areas, and available infrastructure.

Benefits of Utilizing the USDA Loan Program

The USDA loan program offers several advantages for eligible borrowers:

- Low Down Payment: A significant advantage of USDA loans is the ability to purchase a home with a 0% down payment. This eliminates the need for a large upfront investment, making homeownership more attainable for individuals with limited savings.

- Competitive Interest Rates: USDA loans typically offer interest rates that are competitive with conventional mortgages. This can result in lower monthly payments, making homeownership more affordable.

- Flexible Credit Requirements: While credit scores are considered, the USDA program generally has more lenient credit requirements compared to conventional loans. This can be advantageous for individuals with less-than-perfect credit histories.

- No Private Mortgage Insurance (PMI): Unlike conventional loans, USDA loans do not require PMI. This can save borrowers substantial costs over the life of the loan.

- Streamlined Approval Process: The USDA loan program often has a faster approval process compared to conventional loans. This can expedite the homebuying journey.

Navigating the Map: A Step-by-Step Guide

- Locate Your Desired Property: Identify the specific property you are interested in purchasing.

- Consult the USDA Loan Map: Utilize the interactive USDA Loan Map to determine if the property falls within an eligible rural area.

- Verify Eligibility: Once you have confirmed the property’s eligibility, contact a USDA-approved lender to confirm your personal eligibility for the loan program.

- Gather Necessary Documentation: Prepare the required documentation, including income verification, credit history, and property information.

- Submit Your Loan Application: Submit a complete application to the USDA-approved lender.

- Loan Approval and Closing: Once your application is approved, the lender will guide you through the closing process.

Frequently Asked Questions (FAQs) About the Indiana USDA Loan Map

Q: How can I access the Indiana USDA Loan Map?

A: The USDA Loan Map is available online through the USDA Rural Development website. It can be accessed by searching for "USDA Loan Map" or directly through the USDA’s website.

Q: What if my property is located near the border of an eligible and ineligible area?

A: The USDA Loan Map provides a clear visual representation of eligible areas. If your property is located near the border, it is crucial to verify its eligibility through the USDA Loan Map or by contacting a USDA-approved lender.

Q: Can I use a USDA loan to purchase a second home or an investment property?

A: USDA loans are specifically designed for primary residences. They are not available for second homes or investment properties.

Q: What are the income limitations for USDA loans?

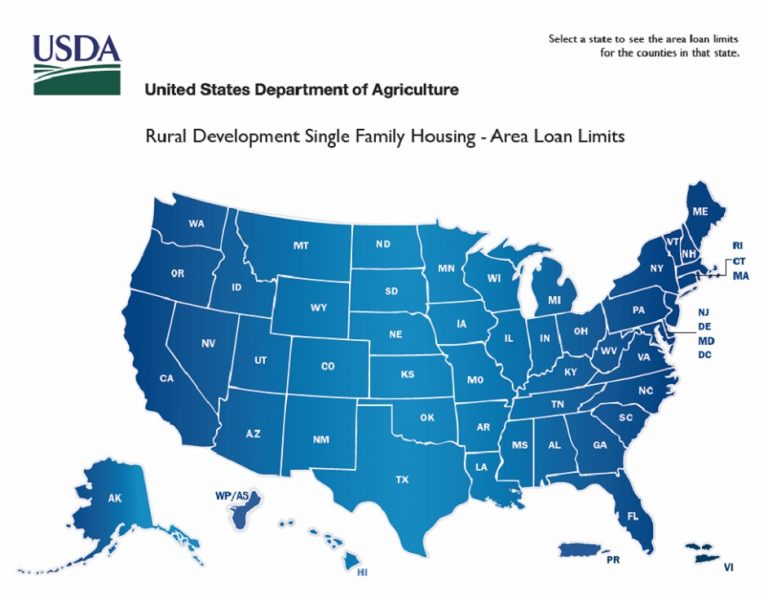

A: The USDA loan program has income limitations based on the number of individuals in the household. The specific income limits vary depending on the geographic location.

Q: What are the credit score requirements for USDA loans?

A: While credit scores are considered, the USDA loan program generally has more lenient credit requirements compared to conventional loans. However, borrowers should aim for a credit score of at least 640 to improve their chances of approval.

Q: Are there any closing costs associated with USDA loans?

A: Yes, USDA loans typically have closing costs, which can include fees for appraisal, title insurance, and other services. These costs can vary depending on the specific property and lender.

Tips for Utilizing the Indiana USDA Loan Map Effectively

- Use the Interactive Map: The USDA Loan Map is interactive and allows users to zoom in and out to view specific areas in detail.

- Consult with a USDA-Approved Lender: Seek guidance from a USDA-approved lender to determine your eligibility and navigate the loan process effectively.

- Review the Eligibility Requirements: Carefully review the USDA loan eligibility requirements to ensure you meet all the criteria.

- Consider the Location: Choose a property located in a rural area that meets the USDA’s definition of eligibility.

- Explore Other USDA Programs: The USDA offers various programs to support rural communities, including loans for home improvements, business development, and infrastructure projects.

Conclusion

The Indiana USDA Loan Map is a valuable resource for individuals seeking to purchase rural properties. By understanding the map and its implications, potential borrowers can navigate the USDA loan program effectively and achieve their homeownership goals. The USDA loan program offers numerous advantages, including low down payments, competitive interest rates, and flexible credit requirements, making it an attractive option for eligible individuals in rural communities. By utilizing the USDA Loan Map and seeking guidance from USDA-approved lenders, borrowers can confidently navigate the path to homeownership in Indiana.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Homeownership: An Overview of the Indiana USDA Loan Map. We appreciate your attention to our article. See you in our next article!